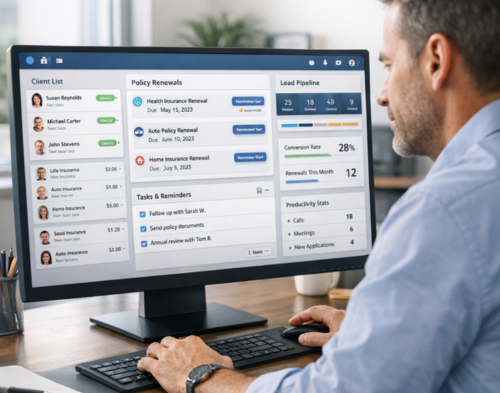

Insurance agents face mounting pressure every single day. Between chasing leads, managing policy renewals, processing claims, and staying compliant with regulations, the workload can feel overwhelming. A single missed follow-up or forgotten renewal can mean losing a client to a competitor.

This is where Customer Relationship Management (CRM) systems become game-changers. The right CRM doesn’t just organize your contacts, it transforms how you work, automates tedious tasks, and helps you build stronger relationships with clients. But with dozens of options available, which ones truly deliver results for insurance professionals?

Here’s a comprehensive guide to the best CRMs for insurance agents in 2025, designed to help you choose a solution that fits your workflow and drives real business growth.

Before diving into specific platforms, let’s address why insurance agents need more than a generic contact management tool.

Insurance agents don’t just sell once and move on. You’re managing ongoing relationships that span years, sometimes decades. Each client might hold multiple policies across life, health, property, or vehicle insurance. A specialized CRM helps you track every policy detail, renewal date, and interaction history in one place.

The insurance sector operates under strict regulatory oversight. From data protection requirements to documentation standards, agents must maintain detailed records of every client interaction. A proper CRM system ensures you’re meeting these obligations whilst protecting sensitive client information.

Manual data entry, policy renewal reminders, and follow-up emails; these tasks consume hours that could be spent serving clients or closing deals. Insurance CRMs automate these processes, freeing agents to focus on what truly matters: building relationships and growing their book of business.

Studies show that 43% of people don’t trust insurance companies due to inconsistent communication. When clients feel neglected or receive generic service, they shop around. A CRM helps you maintain regular, personalized contact with every client, preventing them from slipping through the cracks.

After extensive research and analysis of dozens of platforms, here are the best CRM solutions for insurance professionals.

Best for: Insurance agencies seeking enterprise-grade CRM solutions with expert implementation support

Sailwayz stands out as a premier Salesforce consulting partner that specializes in delivering tailored CRM solutions for the financial services and insurance sectors. Rather than offering a one-size-fits-all platform, Sailwayz provides customized Salesforce implementations designed specifically for insurance workflows.

Key Features:

Why Sailwayz Excels: What sets Sailwayz apart is its consultative approach. They don’t just hand you software; they analyze your specific workflows, regulatory obligations, and client lifecycle management needs before crafting a solution. Their team holds over 50 combined Salesforce certifications, ensuring you’re working with true experts.

For insurance agents, this means getting a CRM that handles complex policy management, commission tracking, and multi-channel client communication without the learning curve typically associated with enterprise software. Sailwayz deploys features in stages, allowing your team to adopt the system gradually whilst maintaining business continuity.

Pricing: Custom pricing based on business requirements and implementation scope. Contact Sailwayz directly for a consultation and quote.

Best suited for: Mid-sized to large insurance agencies, brokers handling multiple product lines, and firms requiring deep customization with ongoing expert support.

Best for: Health, life, and benefits insurance agencies

AgencyBloc bills itself as the number one recommended insurance industry growth platform, and for good reason. This platform was built from the ground up for health, senior, and benefits agencies, offering specialized tools that generic CRMs simply can’t match.

Key Features:

Strengths: AgencyBloc shines in providing a complete view of client relationships. Every email, policy, and interaction appears in one consolidated dashboard, making it easy to service existing clients and identify cross-selling opportunities. The commission management tools are particularly robust, automatically reconciling carrier statements and flagging discrepancies.

Considerations: Solo agents might find the feature set overwhelming. This platform works best for agencies with multiple agents and complex commission structures.

Pricing: Custom pricing based on agency size and feature requirements.

Best for: Life and annuities insurance agents

Insureio is purpose-built for life insurance agents, offering industry-specific functionality that eliminates the need for extensive customization. If you sell life, long-term care, disability, or annuity products, this platform speaks your language.

Key Features:

Strengths: The seamless connection between marketing, quoting, and case management sets Insureio apart. You can run email campaigns, generate quotes across multiple carriers, track application approvals, and manage post-sale servicing from a single dashboard.

Considerations: Less suitable for property and casualty or health insurance agents. The interface isn’t as modern as some competitors, though functionality remains solid.

Pricing: Paid plans start at £25 per month.

Best for: Insurance agents wanting a free, user-friendly starting point

Whilst not insurance-specific, HubSpot CRM offers remarkable value for agents just getting started with CRM technology or those running small operations on tight budgets.

Key Features:

Strengths: HubSpot’s interface is intuitive and requires minimal training. You can be up and running in hours rather than days. The free tier is genuinely useful, not just a limited trial designed to push you toward paid plans.

Considerations: You’ll need to create custom fields and workflows to adapt it for insurance processes. Advanced features like commission tracking and policy management require paid upgrades or integrations.

Pricing: Free for core CRM features. Paid tiers start from £15 per month (billed annually).

Best for: Small to medium-sized agencies seeking affordability and flexibility

Zoho CRM offers extensive functionality at budget-friendly prices, making it popular among growing insurance agencies.

Key Features:

Strengths: The depth of features at this price point is impressive. You get sophisticated automation, detailed reporting, and extensive customization options. The platform scales well as your agency grows.

Considerations: The learning curve is steeper than simpler platforms. Some users report that advanced features are only available at higher-tier pricing plans.

Pricing: Plans start around £12 per user per month.

Best for: Agents prioritizing ease of use and mobile access

Freshsales hits a sweet spot for agents who want modern, clean software without complexity. It’s particularly strong for field agents who need mobile access.

Key Features:

Strengths: The interface feels contemporary and uncluttered. Adding leads, creating deal stages, and sending emails happen quickly without navigating through multiple menus. The mobile app works brilliantly for agents constantly meeting clients.

Considerations: Lacks insurance-specific features like policy management and commission tracking. You’ll need to build custom workflows or integrate third-party tools.

Pricing: Free plan available. Paid plans start from approximately £9 per user per month.

Not all CRM systems are created equal, especially for insurance professionals. Here are the must-have features that separate exceptional platforms from mediocre ones.

Your CRM should track every policy detail, including coverage amounts, premium schedules, renewal dates, and policy changes. This information needs to be instantly accessible when a client calls with questions.

Policy renewals represent easy revenue if you remember to reach out. Top CRMs automatically alert you when renewals approach, often triggering email campaigns to clients beforehand.

Not every lead deserves equal attention. Effective CRMs score leads based on engagement level, policy interest, and likelihood to convert, helping you focus energy on the most promising prospects.

Clients contact you through email, phone, text, social media, and in-person meetings. Your CRM should log every interaction regardless of channel, providing a complete conversation history.

For agencies with multiple agents, tracking commissions can become nightmarish without proper tools. Look for systems that automatically calculate splits, track carrier payments, and generate commission reports.

Insurance CRMs must meet industry security standards, including data encryption, access controls, and audit trails. HIPAA compliance is essential for health insurance agents.

Your CRM shouldn’t exist in isolation. Look for platforms that integrate with your email provider, calendar, accounting software, and carrier systems.

Field agents need full CRM functionality from their smartphones and tablets. Don’t settle for platforms with limited mobile capabilities.

Selecting a CRM is a big decision that impacts your daily workflow and client relationships. Here’s how to approach the choice systematically.

Start by listing your biggest pain points. Are you struggling with lead management? Missing renewals? Losing track of client communications? Your CRM should directly address these challenges.

Consider your agency size and structure. Solo agents have different requirements than teams with multiple producers. Think about whether you need commission tracking, team collaboration features, or sophisticated reporting.

Generic CRMs can work, but insurance-specific platforms save tremendous customization time. If a platform offers built-in policy management, carrier integrations, and compliance tracking, that’s a strong indicator it’s designed for your industry.

Be honest about your comfort level with technology. Some platforms require significant setup and ongoing customization. Others work brilliantly out of the box. If you lack technical staff, prioritize user-friendly options with strong customer support.

Most CRM providers offer free trials. Take advantage of these. Import some actual client data, set up a few pipelines, and try completing your typical daily tasks. You’ll quickly discover which platforms feel intuitive and which feel clunky.

Don’t just look at monthly subscription fees. Factor in setup costs, training time, potential integration expenses, and ongoing maintenance. Sometimes, a higher-priced platform with better features and support delivers better value than a cheap option requiring constant workarounds.

Your CRM should connect with tools you already use email platforms, calendar apps, carrier systems, marketing automation software, and accounting programmes. Seamless integrations prevent data silos and reduce manual data entry.

Understanding what can go wrong helps illustrate why investing in quality CRM software matters.

When information lives in spreadsheets, email folders, sticky notes, and memory, mistakes happen. You might call a client about a policy they’ve already cancelled or mention that they expressed interest in additional coverage three months ago.

Research shows that most sales require five to twelve contact attempts. Without automated reminders, leads go cold because you simply forget to follow up at the right time.

When different agents handle the same client using different processes, service quality suffers. Clients notice when one agent is responsive and organized, whilst another seems scattered and unprepared.

Failing to properly document client interactions or secure sensitive data can result in regulatory fines and reputational damage. Manual record-keeping increases these risks substantially.

Without proper analytics, you’re flying blind. You can’t identify which marketing channels generate the best leads, which agents perform strongest, or which products drive the most revenue.

Purchasing software is just the beginning. Here’s how to ensure you actually get value from your CRM.

Don’t just hand your team login credentials and expect magic. Schedule comprehensive training sessions covering all relevant features. Consider having Sailwayz or another implementation partner provide hands-on coaching.

Garbage in, garbage out. Before migrating to a new CRM, clean your existing contact database. Remove duplicates, update outdated information, and standardize data formats.

Define workflows before implementing them in software. How should new leads be handled? What’s your policy renewal process? Document these steps, then configure your CRM to support them.

Automate repetitive tasks like data entry, follow-up reminders, and routine emails. But don’t automate to the point where client interactions feel robotic. Balance efficiency with personalization.

Set aside time monthly to review how you’re using your CRM. Are there features you’re not leveraging? Workflows that could be improved? Regular optimization ensures you’re getting maximum value.

A CRM only works if your entire team uses it consistently. Get buy-in by demonstrating how it makes their jobs easier. Address concerns and resistance early. Consider incentivizing proper usage.

Choosing a CRM is about finding the right fit for your unique situation. A solo life insurance agent has different needs than a multi-line brokerage with fifteen producers.

Start by clearly defining your challenges and goals. Are you losing leads because follow-up falls through the cracks? Struggling with commission tracking? Wanting better visibility into renewal opportunities? Let these pain points guide your selection.

For insurance professionals seeking enterprise-grade solutions with expert implementation support, Sailwayz offers unmatched expertise in deploying Salesforce for financial services and insurance workflows. Their consultative approach ensures you get a system tailored to your exact business processes, not just generic software.

For agencies wanting specialized insurance functionality out of the box, platforms like AgencyBloc and Insureio deliver purpose-built tools that require minimal customization.

Budget-conscious agents or those just starting with CRM technology will find excellent value in platforms like HubSpot (free tier) or Zoho (affordable paid plans).

The right CRM transforms your insurance business from reactive to proactive, from scattered to organized, from merely surviving to genuinely thriving. Take time to evaluate your options, test drive your finalists, and make an informed choice. Your future self and your clients will thank you.

Ready to explore how a properly implemented CRM can transform your insurance agency? Visit Sailwayz to schedule a consultation and discover how customized Salesforce solutions can streamline your operations and accelerate growth.

What is the most important feature in a CRM for insurance agents?

The most vital feature is comprehensive client and policy management in one centralized location. This includes storing contact details, policy information, interaction history, and renewal dates. Without this foundation, you’ll struggle to provide consistent service. Automated follow-up reminders come in as a close second, as they prevent missed opportunities and maintain regular client contact throughout the policy lifecycle.

How much should insurance agents budget for CRM software?

Expect to invest between £12 and £150 per user monthly for quality CRM software designed for insurance professionals. Entry-level platforms like Zoho start around £12 monthly, whilst enterprise solutions like Salesforce implementations through Sailwayz run higher but offer extensive customization. Factor in setup costs, training time, and potential integration expenses, total first-year costs typically range from £1,500 to £8,000 for small agencies.

Can solo insurance agents benefit from CRM software, or is it only for larger agencies?

Solo agents absolutely benefit from CRM software, often more than larger agencies. When you’re handling every client interaction personally, organization becomes critical. Platforms like HubSpot CRM offer free plans perfect for solo agents, whilst Insureio provides affordable life insurance-specific tools starting at £25 monthly. A CRM helps solo agents compete with larger firms by ensuring professional, consistent follow-up.

How long does it take to implement a new CRM system?

Implementation timelines vary dramatically based on system complexity and your existing data. Simple platforms like Freshsales or HubSpot can be operational in days, whilst enterprise implementations through partners like Sailwayz typically take two to three months. The process includes data migration, customization, integration setup, and team training. Rush implementations often fail better to invest proper time upfront.

Should insurance agents choose industry-specific CRM software or adapt general-purpose platforms?

This depends on your specific needs and technical resources. Industry-specific platforms like AgencyBloc or Insureio work immediately without extensive customization, offering features like policy tracking and commission management out of the box. General-purpose platforms like HubSpot or Salesforce (especially when implemented by experts like Sailwayz) offer greater flexibility and can be tailored to complex workflows, but require more initial setup.

Joshua Eze is the Founder & Salesforce Architect at Sailwayz, a certified Salesforce Consulting Partner based in the UK. With over 6 years of experience leading CRM transformations, he is a certified Application & System Architect passionate about using technology to simplify business processes. Joshua helps companies unlock the full potential of Salesforce with strategic, scalable, and secure solutions.